ТОП просматриваемых книг сайта:

Недвижимость

Различные книги в жанре Недвижимость, доступные для чтения и скачиванияАннотация

Make your money work for you with sound commercial real estate investment strategies If you're looking for more detailed advice on the commercial real estate market than, «Buy low, sell high,» you've come to the right place. Commercial Real Estate Investing For Dummies is where you can find the smart, straightforward, and accurate info you need to get your start—or grow your portfolio—in commercial real estate. You'll learn foundational strategies, tips, and tricks for investing in all sorts of commercial properties, from apartments to shopping malls. You'll also get rock-solid advice on: How to get started in commercial real estate investing, even if you've never tried it before How to work with business and investment partners and protect your own interests with contracts Financing your investments with a variety of instruments and taking advantage of legal tax opportunities Growing wealth by investing in real estate is a strategy as old as money itself. Do yourself a favor and get in on the action with this straightforward and up-to-date guide!

Аннотация

Make foreclosure investing work for you with this practical and easy-to-understand guide Looking to kick start your own property management career? Check out Foreclosure Investing For Dummies, which will get you started buying foreclosed properties to turn into your own income property! In this book, you'll learn to navigate the complexities of home auctions, deal with emotional former homeowners, and how to handle renovations. You'll also get a heads-up on the foreclosure laws in all 50 states so you don't accidentally run afoul of any complicated regulations. Foreclosure Investing For Dummies shows you how to: Locate properties for sale and identify associated opportunities and risks Buy properties below market value at auction, from lending institutions, and from government agencies Fix up, renovate, and sell or lease your new property for a profit This hands-on guide can help anyone make foreclosure investing work. So, grab a copy of Foreclosure Investing For Dummies, roll up your sleeves, and get going!

Аннотация

Среди разнообразия интересных и познавательных книг о работе агента по недвижимости достаточно мало тех, что позволяют по-настоящему проникнуть в суть деятельности риелтора. «Успех в квадратных метрах» – это то редкое издание, в котором читатель обнаружит множество действительно полезных рекомендаций, разглядит ориентиры, которые помогут ему найти свою дорогу в этой непростой профессии. Автор Елена Котова готова дать читателям совет эксперта. Попробуем вместе с ней оценить перспективы, которые открывает современный мир перед риелтором?

Аннотация

Conquer the challenges faced as a woman pursuing financial independence and prosperity In The Female Investor: Creating Wealth, Security, and Freedom through Property , celebrated property and finance experts Nicola McDougall and Kate Hill deliver a practical and approachable guide for women of all ages as they navigate the world of property investing. You'll learn how to build equity and wealth in the property market and achieve financial independence, all while overcoming the gender-based salary deficit and balancing the demands of family and work. You’ll discover invaluable advice on: How to get started with property investing, regardless of what stage of life you're in How to protect your assets in the event of a relationship breakdown and handle «the talk» with your partner when you decide it’s time to join financial forces New strategies and trends for achieving financial independence, like rentvesting and co-buying The Female Investor is an essential read for young women just starting out in the workforce, long-time professionals returning to work after caring for a child, and any other woman trying their best to overcome the financial disadvantages faced by women everywhere. It also belongs in the libraries of anyone else who seeks to support the women in their lives.

Аннотация

Go head-over-heels for house flipping! Flipping houses profitably may not be easy, but it's far from impossible. With the right guide, you can avoid the risks and reap the rewards like a seasoned expert. Flipping Houses For Dummies is that guide. The perfect blueprint to property resale, this book walks you through the absolute necessities of house flipping. You'll learn how to confirm that you have enough time, energy, cash, and resources to be successful. You'll also get an inside look at the house flipping process that'll show you how to minimize risk and maximize profit in a highly competitive market. Flipping Houses For Dummies offers: Proven negotiating techniques to close real estate deals faster House flipping laws and regulations for every state in the union Strategies to successfully complete a big renovation, on-time and on-budget House flipping tips for both investors and contractors Comprehensive content on hiring and working with reputable contractors So, if you're ready to start revitalizing your community by turning neglected properties into prize homes, Flipping Houses For Dummies is the first and last resource you'll need to navigate your way around the exciting and challenging world of real estate investment.

Аннотация

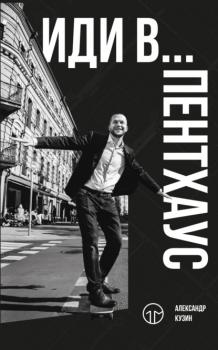

Что отличает собственника агентства недвижимости от начинающего брокера?

Только пройденный путь.

Основатель агентства One Moscow Александр Кузин считает, что такой путь может пройти каждый. Не имеет значения, в каком городе вы родились и сколько зарабатываете, – важно, к какому доходу вы стремитесь, каких условий жизни хотите для себя и своей семьи, а главное – сколько усилий готовы приложить для достижения цели.

Сфера недвижимости дает безграничный простор для роста. Вы можете начать с нуля и за несколько лет сделать головокружительную карьеру. В книге Александр на своем примере рассказывает, благодаря чему это возможно. Делится эффективными инструментами, откровенно говорит о цифрах, победах, провалах и сделанных на их основе выводах. Все это дает вам возможность пройти свой путь быстрее и стать востребованным профессионалом на рынке недвижимости.

Книга будет полезна:

• тем, кто уже выбрал сферу недвижимости для профессионального развития;

• тем, кто хочет увидеть, что скрывается за работой брокера и как выглядит рынок недвижимости изнутри;

• тем, кто ищет по-настоящему прибыльную сферу деятельности.