ТОП просматриваемых книг сайта:

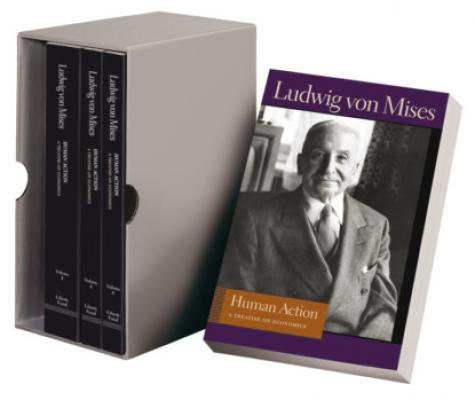

Human Action. Людвиг фон Мизес

Читать онлайн.Название Human Action

Год выпуска 0

isbn 9781614871477

Автор произведения Людвиг фон Мизес

Жанр Зарубежная деловая литература

Серия Liberty Fund Library of the Works of Ludwig von Mises

Издательство Ingram

If acting man has to decide between two or more means of different classes, he grades the individual portions of each of them. He assigns to each portion its special rank. In doing so he need not assign to the various portions of the same means orders of rank which immediately succeed one another.

The assignment of orders of rank through valuation is done only in acting and through acting. How great the portions are to which a single order of rank is assigned depends on the individual and unique conditions under which man acts in every case. Action does not deal with physical or metaphysical units which it values in an abstract academic way; it is always faced with alternatives between which it chooses. The choice must always be made between definite quantities of means. It is permissible to call the smallest quantity which can be the object of such a decision a unit. But one must guard oneself against the error of assuming that the valuation of the sum of such units is derived from the valuation of the units, or that it represents the sum of the valuations attached to these units.

A man owns five units of commodity a and three units of commodity b. He attaches to the units of a the rank-orders 1, 2, 4, 7, and 8, to the units of b the rank-orders 3, 5, and 6. This means: If he must choose between two units of a and two units of b, he will prefer to lose two units of a rather than two units of b. But if he must choose between three units of a and two units of b, he will prefer to lose two units of b rather than three units of a. What counts always and alone in valuing a compound of several units is the utility of this compound as a whole—i.e., the increment in well-being dependent upon it or, what is the same, the impairment of well-being which its loss must bring about. There are no arithmetical processes involved, neither adding nor multiplying; there is a valuation of the utility dependent upon the having of the portion, compound, or supply in question.

Utility means in this context simply: causal relevance for the removal of felt uneasiness. Acting man believes that the services a thing can render are apt to improve his own well-being, and calls this the utility of the thing concerned. For praxeology the term utility is tantamount to importance attached to a thing on account of the belief that it can remove uneasiness. The praxeological notion of utility (subjective use-value in the terminology of the earlier Austrian economists) must be sharply distinguished from the technological notion of utility (objective use-value in the terminology of the same economists). Use-value in the objective sense is the relation between a thing and the effect it has the capacity to bring about. It is to objective use-value that people refer in employing such terms as the “heating value” or “heating power” of coal. Subjective use-value is not always based on true objective use-value. There are things to which subjective use-value is attached because people erroneously believe that they have the power to bring about a desired effect. On the other hand there are things able to produce a desired effect to which no use-value is attached because people are ignorant of this fact.

Let us look at the state of economic thought which prevailed on the eve of the elaboration of the modern theory of value by Carl Menger, William Stanley Jevons, and Léon Walras. Whoever wants to construct an elementary theory of value and prices must first think of utility. Nothing indeed is more plausible than to assume that things are valued according to their utility. But then a difficulty appears which presented to the older economists a problem they failed to solve. They observed that things whose “utility” is greater are valued less than other things of smaller utility. Iron is less appreciated than gold. This fact seems to be incompatible with a theory of value and prices based on the concepts of utility and use-value. The economists believed that they had to abandon such a theory and tried to explain the phenomena of value and market exchange by other theories.

Only late did the economists discover that the apparent paradox was the outcome of a vicious formulation of the problem involved. The valuations and choices that result in the exchange ratios of the market do not decide between gold and iron. Acting man is not in a position in which he must choose between all the gold and all the iron. He chooses at a definite time and place under definite conditions between a strictly limited quantity of gold and a strictly limited quantity of iron. His decision in choosing between 100 ounces of gold and 100 tons of iron does not depend at all on the decision he would make if he were in the highly improbable situation of choosing between all the gold and all the iron. What counts alone for his actual choice is whether under existing conditions he considers the direct or indirect satisfaction which 100 ounces of gold could give him as greater or smaller than the direct or indirect satisfaction he could derive from 100 tons of iron. He does not express an academic or philosophical judgment concerning the “absolute” value of gold and of iron; he does not determine whether gold or iron is more important for mankind; he does not perorate as an author of books on the philosophy of history or on ethical principles. He simply chooses between two satisfactions both of which he cannot have together.

To prefer and to set aside and the choices and decisions in which they result are not acts of measurement. Action does not measure utility or value; it chooses between alternatives. There is no abstract problem of total utility or total value.1 There is no ratiocinative operation which could lead from the valuation of a definite quantity or number of things to the determination of the value of a greater or smaller quantity or number. There is no means of calculating the total value of a supply if only the values of its parts are known. There is no means of establishing the value of a part of a supply if only the value of the total supply is known. There are in the sphere of values and valuations no arithmetical operations; there is no such thing as a calculation of values. The valuation of the total stock of two things can differ from the valuation of parts of these stocks. An isolated man owning seven cows and seven horses may value one horse higher than one cow and may, when faced with the alternative, prefer to give up one cow rather than one horse. But at the same time the same man, when faced with the alternative of choosing between his whole supply of horses and his whole supply of cows, may prefer to keep the cows and to give up the horses. The concepts of total utility and total value are meaningless if not applied to a situation in which people must choose between total supplies. The question whether gold as such and iron as such is more useful and valuable is reasonable only with regard to a situation in which mankind or an isolated part of mankind must choose between all the gold and all the iron available.

The judgment of value refers only to the supply with which the concrete act of choice is concerned. A supply is ex definitione [(Latin) by definition] always composed of homogeneous parts each of which is capable of rendering the same services as, and of being substituted for, any other part. It is therefore immaterial for the act of choosing which particular part forms its object. All parts—units—of the available stock are considered as equally useful and valuable if the problem of giving up one of them is raised. If the supply decreased by the loss of one unit, acting man must decide anew how to use the various units of the remaining stock. It is obvious that the smaller stock cannot render all the services the greater stock could. That employment of the various units which under this new disposition is no longer provided for, was in the eyes of acting man the least urgent employment among all those for which he had previously assigned the various units of the greater stock. The satisfaction which he derived from the use of one unit for this employment was the smallest among the satisfactions which the units of the greater stock had rendered to him. It is only the value of this marginal satisfaction on which he must decide if the question of renouncing one unit of the total stock comes up. When faced with the problem of the value to be attached to one unit of a homogeneous supply, man decides on the basis of the value of the least important use he makes of the units of the whole supply; he decides on the basis of marginal utility.

If a man is faced with the alternative of giving up either one unit of his supply of a or one unit of his supply of b, he does not compare the total value of his total stock of a with the total value of his stock of b. He compares the marginal values both of a and of b. Although he may value the total supply of a higher than the total supply of b, the marginal value of b may be higher than the marginal value of a.

The same reasoning holds good for the question of increasing the available supply of any commodity by