ТОП просматриваемых книг сайта:

Macro Economics ll (Speedy Study Guides). Speedy Publishing

Читать онлайн.Название Macro Economics ll (Speedy Study Guides)

Год выпуска 0

isbn 9781633839342

Автор произведения Speedy Publishing

Жанр Экономика

Издательство Ingram

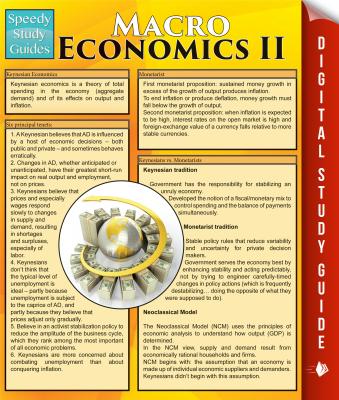

Keynesian Economics

Keynesian economics is a theory of total spending in the economy (aggregate demand) and of its effects on output and inflation.

Six principal tenets:

1. A Keynesian believes that AD is influenced by a host of economic decisions – both public and private – and sometimes behaves erratically.

2. Changes in AD, whether anticipated or unanticipated, have their greatest short-run impact on real output and employment, not on prices.

3. Keynesians believe that

prices and especially

wages respond slowly

to changes in supply

and demand,

resulting in

shortages and

surpluses,

especially

of labor.

4. Keynesians

don’t think that the

typical level of

unemployment is

ideal – partly because

unemployment is

subject to the caprice of

AD, and partly because they believe that prices adjust only gradually.

5. Believe in an activist stabilization policy to reduce the amplitude of the business cycle, which they rank among the most important of all economic problems.

6. Keynesians are more concerned about combating unemployment than about conquering inflation.

Monetarist

First monetarist proposition: sustained money growth in excess of the growth of output produces inflation.

To end inflation or produce deflation, money growth must fall below the growth of output.

Second monetarist proposition: when inflation is expected to be high, interest rates on the open market is high and foreign-exchange value of a currency falls relative to more stable currencies.

Keynesians vs. Monetarists

Keynesian tradition

Government has the responsibility for stabilizing an

unruly economy.

Developed the notion of a fiscal/monetary mix

to control spending and the balance of payments simultaneously.

Monetarist tradition

Stable policy rules that reduce variability and uncertainty for private decision makers.

Government serves the economy best by enhancing stability and acting

predictably, not by trying to engineer

carefully-timed changes in policy actions

(which is frequently destabilizing . . . doing the opposite of what they were supposed to do).

Neoclassical Model

The Neoclassical Model (NCM) uses the principles of economic analysis to understand how output (GDP) is determined.

In the NCM view, supply and demand result from economically rational households and firms.

Конец ознакомительного фрагмента.

Текст предоставлен ООО «ЛитРес».

Прочитайте эту книгу целиком, купив полную легальную версию на ЛитРес.

Безопасно оплатить книгу можно банковской картой Visa, MasterCard, Maestro, со счета мобильного телефона, с платежного терминала, в салоне МТС или Связной, через PayPal, WebMoney, Яндекс.Деньги, QIWI Кошелек, бонусными картами или другим удобным Вам способом.